Summary:

What is ‘Taking Leverage’?

Simply put, by providing Collateral you can then borrow multiple times the Collateral amount by paying an ARCH token fee to access Leverage. Here is a hypothetical Archimedes example:

- You open a position with Archimedes that has 10,000 OUSD as Collateral

- You can borrow x10 times that collateral amount.

- So, now your Total Position Value is roughly 100,000 OUSD

- This means you now earn OUSD’s base interest on the Total Position of 100,000 yield barring OUSD

What is the Underlying Asset/Collateral?

The types of assets that Archimedes leverages are called Yield-bearing stablecoins.

What are “Yield-bearing stablecoins”?

“Yield-bearing stablecoins” have the following characteristics:

- Pegged 1:1 to the USD (and in the future BTC, ETH, etc…)

- Natively appreciating: the stablecoins protocol team runs a strategy that generates yield for the stablecoin holders

- No negative yield scenario: When everything works, these stablecoin yields are always above 0% APY

Which “Yield-bearing stablecoins” does Archimedes support?

Archimedes currently supports OUSD from Origin Protocol: https://www.ousd.com/

We will be adding more partners and Yield-bearing stablecoins in the near future. Stay tuned

Archimedes does not support any other tokens not listed above.

Please beware of scams!

Which other “Yield-bearing stablecoins” can you expect in the future?

Archimedes will continue developing partnerships to provide its users with the best opportunities in the market. Archimedes only partners with battle-tested stablecoins that we have carefully vetted for quality, with great value proposition to its and our users, and that have doxxed and ethical teams.

A few of the stablecoins that Archimedes’ team believes present all of those characteristics and pass its initial screening are LUSD, sUSD, stETH, etc. See our Product Roadmap.

Following Archimedes’ initial screening and prioritization, the team then conducts a thorough due diligence and audit on the chosen stablecoin and their strategy, which will be published upon completion.

How Do I Get Leverage?

You obtain Leverage as part of the Open Position process as long as there is Leverage (lvUSD) available. We make Leverage (lvUSD) available through our Leverage Rounds. You can also learn more about both of these here:

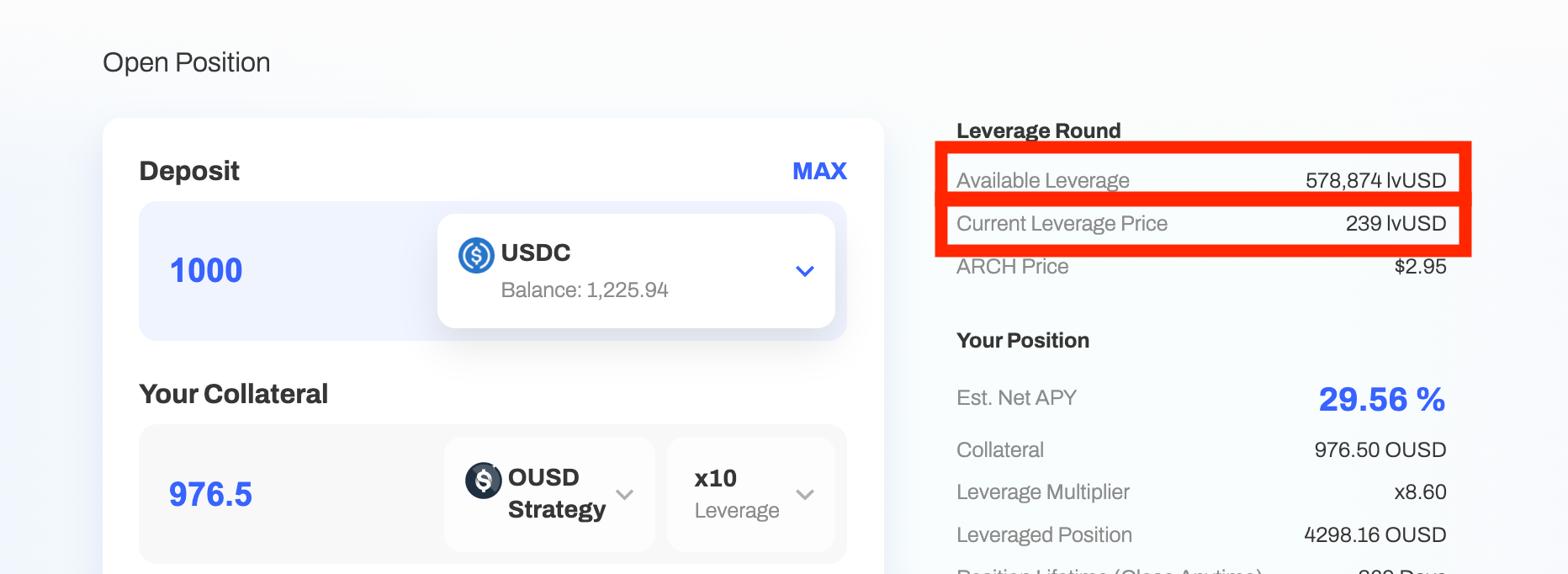

You can check the availability and price of Leverage (lvUSD) by taking the following steps:

- Go to the Open Position page and check the ‘Available Leverage’ area to confirm there is leverage (lvUSD) available to open a position.

- Check the ‘Current Leverage price’ heading to determine the price. Price may fluctuate, please read the next section to learn more.

- If there is lvUSD availability and it is at a price that you like then continue to Open a Position by following these steps

Protocol Fees

There are 3 types of fees associated with the Archimedes Protocol:

- Leverage Fee

- Origination Fee

- Performance Fee

All fees are collected and sent to the Archimedes Treasury to later be used to incentivise and reward the Liquidity Providers (Lenders) of the 3CRV/lvUSD Curve Pool. This ensures the sustainability of the Archimedes Ecosystem and facilitates the Liquidity growth needed for our Leveraged Positions.

The fees are collect in both ARCH tokens and the Collateral Asset to further diversify the Treasury.

Leverage Fee (ARCH Token)

When a user Opens a Position they pay some ARCH tokens as an upfront fee to access the leverage (lvUSD) needed for the positions duration. You don’t need to own ARCH tokens because our Open Position process will convert and take the fee for you. The exact amount of ARCH tokens required is determined by our Leverage Round process which you can learn more about here.

In short, the price of Leverage (lvUSD) starts at a higher price early in the Leverage Round and gradually lowers over a set time period until it hits a floor price or until all the leverage is acquired, whichever happens first. The fee is collected and sent to the Archimedes Treasury and contributes to rewarding Liquidity Providers.

Origination Fee (Collateral Asset)

When a user Opens a Position there is a one time 0.5% origination fee applied. This 0.5% amount is applied to the leverage amount (borrowed amount) and is collected from the collateral asset (OUSD). The fee is sent to the Archimedes Treasury and contributes to rewarding Liquidity Providers.

Performance Fee (Collateral Asset)

All ‘Estimated Net APY’ percentage yields that we quote for our Leveraged Positions across our platform already deduct the performance fee in the calculation. And therefore, you don’t need to adjust your APY projections for this Performance Fees.

The Performance Fee is 30% and it applies only to the Interest Earned from full position (interest earned from Collateral and Leverage). This fee is deducted from the interest earned and is taken only when the position is closed or when it expires.

- If the position does not earn any interest then no performance fee is applied

The Fee amount is collected in the same asset as the Interest Earned and is sent to the Archimedes Treasury to be used to reward Liquidity Providers.

Note that there may be slippage when closing or unwinding your position. This cost is due to the relevant token exchange estimations used (eg. swapping your position OUSD to lvUSD) during the closing transactions. This slippage amount does not go to the protocol

For a more detailed Step by step guide to opening and closing a position please click here:

How To Open a Leveraged Position (Step-by-Step)How To Close a Leveraged Position (Step-by-Step)Archimedes is an experimental protocol and carries significant risks: Smart contract risk, economic model risk, risk that the assets Archimedes introduces and many other types of known and unknown risks.

Archimedes' team never provides investment advice. This article is NOT financial advice. DYOR.

Participate at your own risk.