TL;DR:

- The Archimedes Liquidity Pool is now Live on Curve.fi here

- Considered APY using our unique Dynamic Emissions

- Our minimum Target APY is ~15%

- Transparent Yield and Transparent Team:

- We explain where the APY comes from

- The team is doxxed and co-founded by MIT alumni

- The code is open source

- We have audited our code with Halborn Security

Provide liquidity here: Curve.fi

Or, read of Step-by-Step guide on How to provide liquidity

Archimedes’ 3CRV/lvUSD Curve Pool is now live on Ethereum Mainnet and users can now provide liquidity and earn from our Dynamic Emissions.

There are two other upcoming events you may want to note:

- On February 17th: We go live with our ARCH/USDC Pool in Uniswap V2

- On February 20th: We open the first Leverage Round

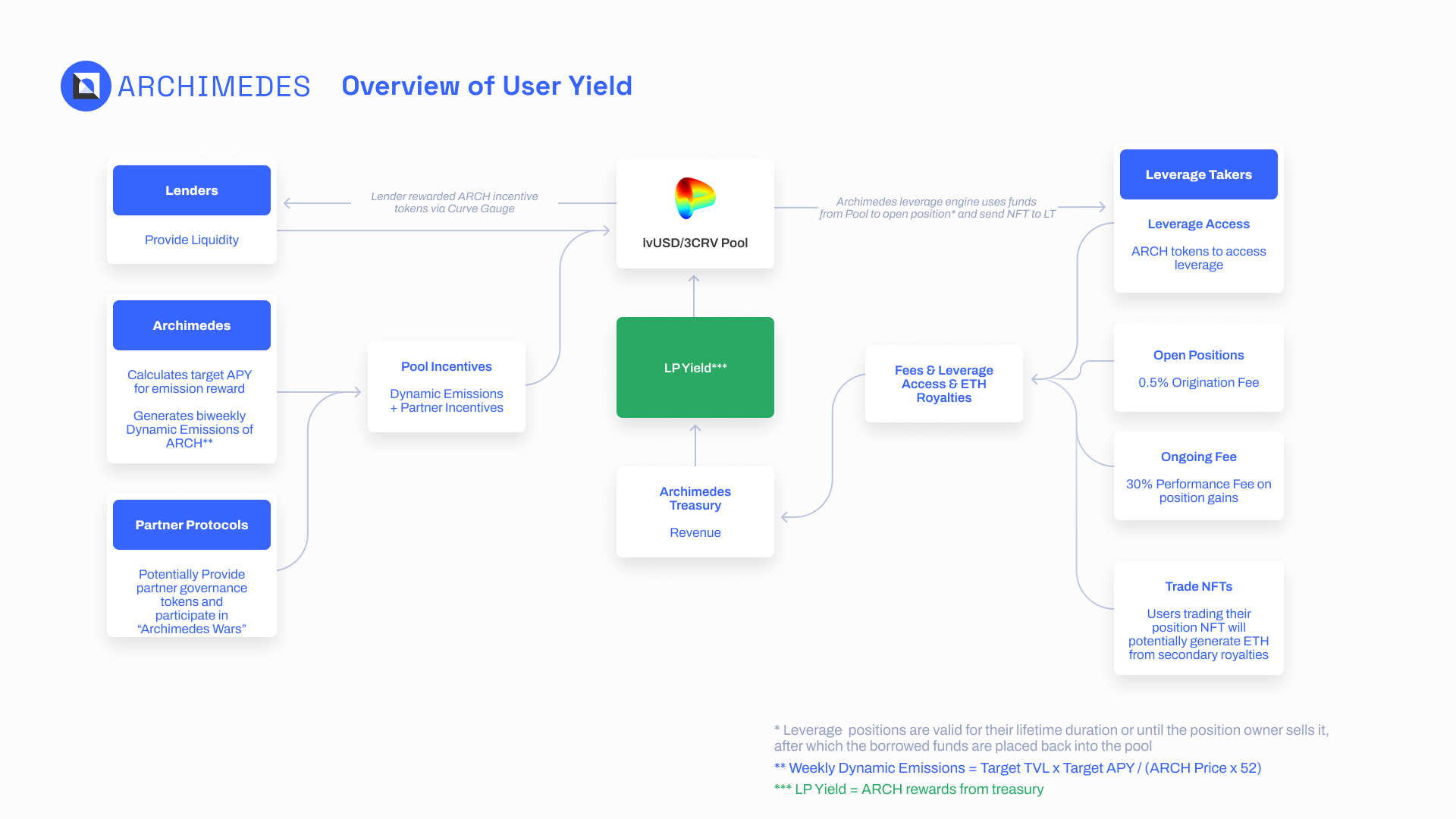

Archimedes adds new twists to DeFi’s lending and borrowing, including leverage and NFTs for borrowers, and in the future a Real Yield earning opportunity for liquidity providers. Archimedes makes it so that DeFi users can earn top of the market APY returns with their stablecoins, projected to start at ~15% for Lenders!Without getting too deep into the Leverage, Archimedes is able to provide borrowers with up to 10x leverage on their own yield-generating assets. The leverage is powered by incentivizing LPs (liquidity providers) to park their otherwise idle stablecoin assets in the Archimedes 3CRV/lvUSD liquidity pool, a pool made up of all stablecoins, on Curve Finance. This specific stablecoin pairing of 3CRV and lvUSD (Archimedes own internal stablecoin) provides the LP a more passive yield generating experience, and an APY that consistently competes for best in the industry.

Why is Archimedes different for LPs:

Currently in DeFi users that provide liquidity (LPs) are faced with many challenges, but Archimedes solves these:

- Yield Transparency - Know where yields come from

- Considered APY - No more over-inflation of rewards tokens

- Native Token Utility - ARCH token has utility to create real demand

Yield Transparency

Let’s start with the issue of transparency on where yields come from. During user interviews, our team found that most LPs are frustrated with the lack of transparency about where the yields are coming from. This is not only true for CeFi, but also within most DeFi projects.

Archimedes addresses transparency concerns head-on via a concept the team refers to as “building in public”. This means that Archimedes smart contracts are open-source and available on Github, and in like kind the team puts forward a strong effort to redistribute this information in various forms via social media posts on platforms like Twitter, Medium and YouTube

For a more detailed description of how Archimedes LPs earn from our Dynamic Emissions, check out this thread on Twitter.

The TL;DR of this read is that Archimedes LPs earn ARCH rewards from the protocol treasury which collects fees in the form of, leverage taking fee, an origination fee whenever a borrower opens a leveraged position, and a performance fee, which actively collects 30% of the yield from leveraged positions. It’s worth noting that since Archimedes only deals with blue-chip yield-generating assets, these are the same tokens that LPs receive as a reward – along with ARCH tokens and a small amount of CRV (Curve’s native token).

Considered APY

While some DeFi projects have rewards tokens that have no max supply or utility other than governance, the Archimedes ARCH token is a stark contrast. Not only does ARCH have a max supply, the 3CRV/lvUSD pool also abides by a dynamic emissions schedule. The dynamic emissions schedule was created to tackle the potential issue of ARCH tokens over-inflating, which helps Archimedes LPs receive top of market yields over the long-term. How this works is, the emission rate of ARCH tokens is adjusted every week to ensure that the token is keeping up with the top 10 available APYs in the market.To learn more about Archimedes’ dynamic token emissions and how they work, check out this article written by the Archimedes team on Medium.

Native Token Utility (ARCH)

Borrowers need LPs for leverage to be made available. This means that Archimedes' leverage is scarce and can be depleted leading to no new leverage positions being available until more liquidity enters the pool. Whats more, LPs are rewarded a valuable asset which borrowers need in order to obtain access to what leverage is available: ARCH token, which is farmed by Archimedes LPs.Thanks to the ARCH’s utility that is needed by borrowers, there is less incentive for LPs to simply sell ARCH tokens as there is a demand for the token. This gives Archimedes liquidity providers more control over the system than other projects that need to rely only on a governance vote in order to make an impact.

Provide liquidity here: Curve.fi

Or, read of Step-by-Step guide on How to provide liquidity